Dental Coding Audits

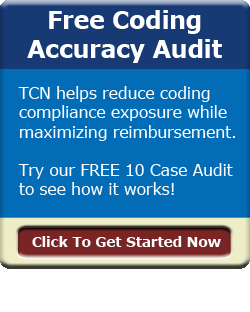

Dental practices should periodically audit their coding to minimize compliance risk and optimize revenue. Many private payers, Medicaid’s Special Investigative Units (SIU’s), and the Department of Justice have had recently increased their focus on compliance, especially since children’s dentistry is now covered by the Affordable Care Act, a/k/a “Obamacare”. They are auditing dental practices with greater frequency to detect fraud, waste, and abuse. These compliance audits can lead to large recoupment payments from practices. In our experience, many practices that are caught for fraud aren’t purposefully committing criminal acts, they are simply victims of deficient coding or documentation knowledge. Periodic coding audits will help you catch these deficiencies in your practice’s coding or documentation skills before a payer audit, giving you proper time to fix any issues.

Most dental providers never receive proper training in documentation and coding or delegate this task to untrained receptionists. Our audits commonly uncover documentation deficiencies, which can inadvertently lead to lower payments and missed revenue as well as legal exposure. We often identify cases in which providers properly document their services but aren’t coding for every procedure they perform, which can also lead to lower payments.

Our years of experience in performing coding and auditing projects as part of dentists’ legal settlements with the Office of the Inspector General and The Department of Justice have given us a deep understanding of both the risks that practices face and the importance of prudent and early action. Accurate coding requires walking a fine line. Your practice wants to optimize revenue by accurately coding for each service rendered, while simultaneously ensuring that your coding and documentation aren’t opening the practice up to any compliance issues. The Coding Network’s dental audits will help you determine just how accurate your coding is and what effect it is having on your compliance risk and revenue cycle.

Latest Blog Posts:

Why Human Oversight in AI Medical Coding Remains Essential in 2025

The emergence of AI in medical coding is invariably impacting healthcare and traditional workflows and resource allocation. Yet, as AI platforms tout accuracy rates exceeding 90%, a critical question persists: Can autonomous coding stand alone? [...]

AI Medical Coding Is Fast—Until Compliance Slows You Down

Why Human Validation Is Now Mission‑Critical (and How to Add It Overnight) Artificial‑intelligence engines from Aidéo, Fathom, Nym, 3M, and others are transforming medical coding speed. Yet payers haven’t lowered the bar— they’ve raised it. Humana, [...]

How to Dodge the Holiday Coding Backlog – Without Adding Full‑Time Staff

Summer vacations fill the calendar, and Labor Day marks the starting line of a four‑month holiday sprint. For revenue‑cycle leaders, that means one thing: charts start stacking up on Friday, coders walk in Monday to a [...]

Need Professional Medical Coding Assistance: Why Using Your Doctors To Code Is Not Free

In today’s fast-paced healthcare environment, efficiency and accuracy are non-negotiable. Every medical practice, hospital, and healthcare system strives to optimize revenue, ensure compliance, and deliver exceptional patient care. One area that often flies under the [...]